In an October 2016 Mises Institute talk, Jeff Deist declared that “…today’s campuses are a microcosm of what progressives have in store for society in general. And part of that vision requires a degree of collective ignorance and even amnesia about entire fields of knowledge.” Regarding economics, Deist noted “that we now have an entire generation of supposedly mainstream economists who fundamentally don’t understand: economics as a social science; money as a market commodity; inflation as a monetary phenomenon; interest rates as prices; and economic booms and busts.” In short, they are lost.

In the 1970s television series, Land of the Lost, the Marshall family found itself trapped in an alternate universe inhabited by dinosaurs, a primate-type people called Pakuni, and aggressive humanoid/lizard creatures called Sleestak. During each episode, this lost family sought to survive and find a way back to their own world.

Now you might ask, what does a television show about lost humans have to do with economics? Plenty.

Similar to today, the world I grew up in was filled with contention. During the 1980s, I remember my college economics courses being filled with opposing ideas. Back then, President Ronald Reagan had disturbed the dominant Keynesian consensus of active government involvement in the economy through taxation and spending. His deployment of Supply-side economics had deliberately shifted the focus away from government through reduced marginal tax rates, deregulation, and an emphasis upon increased personal risk taking, entrepreneurship, and innovation. By the way, don’t these policies sound familiar to those now advocated by President Trump?

But during the 1980s, while we debated the merits of taxes, regulation, and government’s role in the economy, there existed a bipartisan understanding that debt was something to be avoided (or at least, minimized). To this day, I can still remember candidate Reagan chastising President Carter as the National Debt approached the $1 trillion threshold. While we need to consider the Debt-to-GDP ratio, there was nevertheless a powerful optic in crossing that number. While it had taken the U.S. two centuries to reach a $1 trillion debt, we now accomplish that feat every two years! And in the most recent presidential administration, the eight years of President Obama nearly doubled the debt from $11 trillion to more than $19 trillion. To once more invoke Mr. Deist:

“If there is one overriding economic myth that plagues us today it is the notion that society can do collectively what we cannot do individually: get rich by living today at the expense of tomorrow. It is the doctrine of the political class, professional economists, and central bankers. It is monetary and fiscal hedonism masquerading as technical analysis. And, it leads to fiscal default. It is arguably the biggest untold story of our time, but you won’t hear about it from Hillary or Bernie or Donald.”

For those of you who’ve been following the story of Illinois’ fiscal crisis, you are aware that the state’s debt has been downgraded. The Associated Press reports that “Illinois is on track to become the first U.S. state to have its credit rating downgraded to junk status, which would deepen its multibillion-dollar deficit and cost taxpayers more for years to come.” Additionally, FoxNews states that “Illinois is grappling with a full-fledged financial crisis and not even the lottery is safe – with Republican Gov. Bruce Rauner warning the state is entering “banana republic” territory.” But perhaps Rep. Peter Roskam, R-Ill., said it best: “This avoidance in behavior toward dealing with our challenges is what leads to the devastating impacts we are seeing today. Illinois is the fiscal model of what not to do.”

Given all of this, what might we do to right our financial ships (personal, state, and national levels) that have already taken on or are now beginning to take on water? As you might expect, there are different versions regarding what can or cannot be done.

Should we cut spending? Both sides of the aisle, Democrat and Republican, indicate that there are few expenditures that can be cut or even slightly reduced. They note that there are certain things such as Social Security, Medicare, and Food Stamps which Americans are “entitled” to receive. Aside from these, there are other things such as defense, education, roads, airports, and libraries. “And gee, they’re important, too.” So, for all of the above and our future lists, our collective response is: “We need them all and we need them now.”

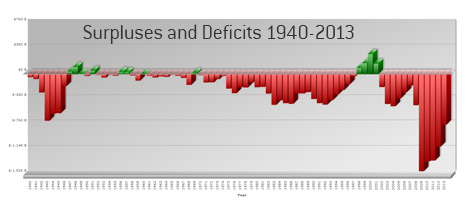

Fair enough. So let’s pay for our “essential” government services. Before doing so, however, I’ve included a graph of surpluses and budget deficits since 1940.

While the individual numbers are unimportant, you’ll note that the U.S.A. has experienced a wash of red ink. This year, for example, we’re expecting a federal operating deficit of approximately $450 billion. And so, out of fairness to future generations, there is a simple way we may settle this up. By a simple division of our $450 billion budget deficit over 330 million Americans, we’ll arrive at $1363 due for every man, woman, and child. So, early next month, please expect a special invoice from the I.R.S. payable upon receipt for services received. This will likely result in some fireworks, but what better time of the year than Independence Day?

Fair enough, right? Not so fast, we say. Our collective taxes are already too high! And there is already precedent for our receipt of government services for which we have been unwilling to pay for. So, let’s try this instead. Let’s all send an email or text or Snapchat to our elected representatives instructing them to issue more U.S. Treasury bonds and pass this debt on to our children and grandchildren. Let the kids worry about it. For as the late economist, John Maynard Keynes, once said: “In the long run, we’re all dead.”

On May 23, 1857, in a letter from Lord Macaulay to an American friend, the English writer and historian (1800-1859) observed the fate of democracies and noted that the average age of the world’s greatest democratic nations has been 200 years. Each has been through the following sequence:

From bondage to spiritual faith.

From faith to great courage.

From courage to liberty.

From liberty to abundance.

From abundance to complacency.

From complacency to selfishness.

From selfishness to apathy.

From apathy to dependency.

And from dependency back again into bondage.

While the stage at which we reside may be debated, I do wonder…Do we now reside in a land where debt that can never be repaid is readily accepted as the source of our standard of living? Do we now live in a land where our every desire has become our entitlement?

For those accustomed to living in a world like this, how will they ever see the dinosaur standing before them? For those who’ve read the tea leaves of history, it is clear that if this generation doesn’t change things, we are truly lost.

The Democrat Party exists solely to create dependency and they accomplish this by buying votes with other people’s money. They count on useful idiots who have given up on individual freedom and blame others. Socialism is the game Democrats are playing despite the fact socialism has never worked.

If it’s good, the government ought to give it to us. Jobs, housing, health care, education we need it ALL! We need it NOW! How do you pay for it all? Tax the rich. Do I have a plan? YES! The Nero economic school approach. When the Roman emperor Nero ran out of money, he taxed the patricians(Roman rich people). When the patricians ran out of cash, he decreed that they were all his heirs, and that when they died he would inherit all their property. When the patricians started to live too long, Nero sent the Praetorian guard to speed their demise. Write your elected representatives today, and urge them to adopt my plan. What could go wrong?

Social Security is not an entitlement. We paid for it. Please don’t lump it with food stamps and welfare!

Editor Note: It is true that Social Security should not be considered an entitlement. However, government mismanagement of this program through the years has left the Social Security Trust Fund in a dire circumstance. Without tax increases or benefit reductions for future S.S. recipients, the mathematics of the program do not work.

The disability part of social security is more like an entitlement. You get it if you are disabled even if you have not paid much!