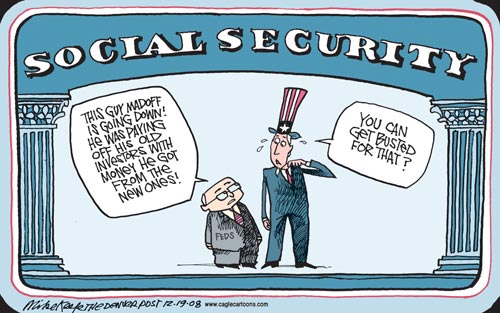

So if there are real assets in the Social Security Trust Fund, $2.6 trillion allegedly, then how could failure to reach a debt ceiling agreement possibly threaten seniors’ Social Security checks? The answer is that the federal government has borrowed all of that trust fund money and spent it. The only way the trust fund can get cash to pay Social Security benefits is if the federal government draws it from general revenues or borrows money, which of course, it can’t do because of the debt ceiling. Shock you?

Social Security benefits are entirely self financing. They are paid with payroll taxes collected from workers and their employers throughout their careers. These taxes are placed in a trust fund dedicated to paying benefits owed to current and future beneficiaries. The Social Security trust fund is a fiction. In other words, the Social Security trust fund contains nothing!

The Social Security Administration of the United States actually oversees two separate funds that hold federal government debt obligations related to what are traditionally thought of as Social Security benefits. The larger of these funds is the Old Age and Survivors Insurance Trust Fund, which holds in trust those interest bearing securities that the federal government intends to redeem to pay future benefits to retirees and their survivors. The second, smaller fund is the Disability Insurance Trust Fund, which holds in trust those securities that the federal government intends to redeem to pay benefits to those judged by the federal government to be disabled and incapable of productive work, as well as their spouses and dependents. The trust funds are also “off budget” and treated separately from other Federal spending.

If the current budget crisis has done nothing else, it has exposed the decades-long lie about the solvency of the Social Security trust fund. The trust fund may be backed by the “full faith and credit of the federal government,” but if it had real assets Mr. Obama wouldn’t be talking about seniors missing their August checks. The Office of Management and Budget has described the trust fund function as:

“These trust funds balances are available to finance future benefit payments and other Trust fund expenditures, but only in a bookkeeping sense. They do not consist of real economic assets that can be drawn down in the future to fund benefits. Instead, they are claims on the Treasury that, when redeemed, will have to be financed by raising taxes, borrowing from the public, or reducing benefits or other expenditures. The existence of large trust fund balances, therefore, does not, by itself, have any impact on the Government’s ability to pay benefits.”

So you can now relax knowing that not only is our government broke, the trust fund that was supposed to contain money to pay seniors’ future benefits is all smoke and mirrors.