Oil Prices, Market Size, Division of Labor, Productivity and the Standard of Living are all related and Waving Red Flags at mounting Problems

Economics textbooks have become much larger and much, much, more expensive. Nonetheless, it seems that they have forgotten to cover some basic issues resulting in students seeming to have gaps in their ability to analyze every day issues. One of these basic economic principles given short shrift in most current textbooks is that of the ‘size of the market’.

Adam Smith in his “Wealth of Nations,” made this a crucial issue when he discussed his ‘Pin Factory’. He pointed out that the larger the market the greater the degree of the division of labor or specialization of the productive resources and the greater the productivity of the resource such as labor.

Those ten persons, therefore, could make among them upwards of forty- eight thousand pins in a day. Each person, therefore, making a tenth part of forty-eight thousand pins, might be considered as making four thousand eight hundred pins in a day. But if they had all wrought separately and independently, and without any of them having been educated to this peculiar business, they certainly could not each of them have made twenty, perhaps not one pin in a day; that is, certainly, not the two hundred and fortieth, perhaps not the four thousand eight hundredth part of what they are at present capable of performing, in consequence of a proper division and combination of their different operations.

Brick making is a modern case in point. There is no one superior way of making bricks. It depends upon the size, or as they used to say, the extent of the market. In regions where the amount of bricks needed is small, what appears to be an archaic way of brick making is usually the best way in an efficiency sense. Find some appropriate soil, dampen it, and mix in some kind of straw. Once the brick material is properly prepared, place the mixture in a wooden mold and leave it in the sun to harden.

In a densely populated and economically developed modern metropolis, that approach to brick making would be a disaster. What you would probably find in a modern brick factory is an electric furnace to bake the bricks shaped by some high speed molding device. This technology would use much more capital relative to labor. The fixed costs of brick making, reflecting a capital intensive approach, would be much higher in a total sense but relatively low per brick and low relative to labor costs that utilized a less advanced technology.

Productivity per unit of labor would be much lower in the simpler case, but nonetheless where few bricks are demanded, i.e. in a smaller market, the simpler technology is the better one, economically. Of course, if imports from other nations’ markets where brick making is able to use more technologically advanced methods due to a large population and a greater effective demand, total cost per brick is relatively low and if transportation costs are not prohibitively high, the nation with the simpler technology would benefit from importing the bricks rather than making the bricks, although this might infuriate the domestic guild of brick makers.

This more technologically advanced way of brick making would be financially ruinous if only a few hundred bricks per day were the demand.

I am an ardent fan of the Military and Military History cable channels. They are two of the few channels that present a lot of history since much of history is made and shaped by wars, their causes and consequences.

One point made by an often repeated short scenario about the Second World War, was the recruitment of Henry Ford and the highly specialized production methods he introduced in order to increase bomber production. It is often referred to as the assembly line with its utilization of standardization of parts. As a number of commentators on these channels have stated, including a variety military personnel, besides the skill and sacrifice of the troops themselves, it was the mass production methods of the U.S. that ultimately swamped the Axis Powers.

The FDR Lesson Obama Should Follow Roosevelt reluctantly unleashed industry to win World War II, thereby laying the groundwork for America’s economic recovery. According to Arthur Herman (WSJ, May 9, 2012),

The results, as Knudsen had promised, were staggering. Barely a year later—by the time Japanese bombs fell on Pearl Harbor in December of 1941—the scale of American war production was fast approaching that of Nazi Germany.

America truly became the “arsenal of democracy” (the phrase Knudsen invented). By the end of 1942 we were producing more tanks, ships, planes and guns than the entire Axis; by the end of 1943 more than Germany, the Soviet Union and Britain combined.

The ability to bring parts and components from highly specialized producers nationwide to central assembly points such as the Willow Run Bomber Plant in Southeastern Michigan, and the ease of transporting that finished equipment of war to the battlefields was vital in makings this system work so efficiently. According to Wikipedia,

At its peak, Willow Run produced 650 B-24s per month by 1944. By 1945, Ford produced 70% of the B-24s in two nine hour shifts. Pilots and crews slept on 1,300 cots waiting for the B-24s to roll off the assembly line at Willow Run. Ford produced half of the 18,000 total B- 24s at Willow Run. The B-24 holds the distinction of being the most produced heavy bomber in history.

The same argument can be made for the very high standard of living experienced in recent years by the average U.S. resident in terms of consumer goods in general as well as the relatively low cost of business durable goods such as our civilian air fleet and trucking industry, among many others.

The U.S. population including its productive resource base such as labor, has become the most mobile in the world and has lead to an increasingly efficient economic use of the American productive resources. Ease of temporary travel and more permanent migration among the fifty states and its territories has been a hallmark condition experienced within this nation.

The highway system, numerous airports, the rejuvenated rail system and inland water transport all blend together to give us a very large and unified market for the fabrication and distribution of millions of goods and services.

Many markets have become increasingly internationalized with advances in air transportation and the shipment of raw materials and finished goods by such things as container ships and highly automated shipping ports.

The enlargement of these markets has enabled a quantum jump in the division of labor and other resources such as capital and entrepreneurship. This has tremendously increased the productivity of our productive resource base (labor, capital, entrepreneurship and land) and given us such a high standard of living.

BUT IT IS NOW IN JEOPARDY. We are not referring to the Somali pirates or occasional trade wars. This is not to minimize the negative impact of terrorism. One of the major threats to the unity and enlargement of markets is the growing cartelization of the oil and natural gas industries and the refining and distribution of their refined products.

The East coast of the U.S. is the most vulnerable region. It is referred to as PADD 1 (Petroleum Administration Defense District), a designation resulting from the mobilization of this nation as the Second World War engulfed us.

For various reasons, a number of refineries bringing downstream refined petroleum products such gasoline, home heating oil, diesel and jet fuels to the East Coast of this nation, have closed or will soon close. In fact the threat is so imminent that Delta Airlines announced it was buying and will operate one of these refinery facilities in order to secure sufficient fuel for its airline to operate. According to a May 2, 2012 article in The Week (Should more airlines follow suit?),

But Delta has recently hit on a novel, if blunt, solution: It’s simply going to buy an oil refinery in Pennsylvania from ConocoPhillips for $150 million. Delta will be the first airline to enter the oil refinery business, and the decision to go where no airline has gone before carries huge risks — and possibly offers huge rewards as well.

The new threat to the profits and high rates of return on equity of the now enhanced oil cartel, which in addition to OPEC unofficially includes the U.S. major oil firms, namely the production from shale deposits with their huge potential reserves of natural gas, oil and other hybrid liquids, has put severe downward price pressure on natural gas and increasingly threatening the substitution of electric power production to natural gas from oil and coal. Marcellus (Pennsylvania), Bakken (North Dakota and Montana), Eagle Ford (Texas), Monterey/Santos (in the Santa Maria and San Joaquin Basins in California), etc. are becoming commonly known sources for competition to existing major oil firms here and abroad.

According to the U.S. Department of Energy (Energy Information Administration Review of Emerging Resources U.S. Shale Gas and Shale Oil Plays (July 2011),

INTEK shale report’s assessment of technically recoverable shale oil resources, which amount to 23.9 billion barrels in the onshore Lower 48 States. The largest shale oil formation is the Monterey/Santos play in southern California, which is estimated to hold 15.4 billion barrels or 64 percent of the total shale oil resources shown in Table 1. The Monterey shale play is the primary source rock for the conventional oil reservoirs found in the Santa Maria and San Joaquin Basins in southern California. The next largest shale oil plays are the Bakken and Eagle Ford, which are assessed to hold approximately 3.6 billion barrels and 3.4 billion barrels of oil, respectively.

As expected, these major firms are moving to control these new and competing sources of energy. According to the Wall Street Journal (Gas Drilling Slows, Heating Up Prices, May 3, 2012):

Exxon Mobil Corp., Encana Corp. and ConocoPhillips, among the country’s largest natural gas producers, said in recent days they reduced production in the first quarter and pledged to reduce drilling further in coming months. And government data earlier this week showed output in February had the biggest percentage drop in a year….Importantly, they say, the pullback in production has coincided with a sudden pickup in demand from users, such as power plants, which are trying to capitalize on falling prices.

We have already seen the results of the broadened oil cartel on transportation costs which have risen precipitously over the past few years. The recent fall-off in those costs in the past few months is likely related to the general economic decline. Commercial airline traffic has lost its long term trend of rising passenger mile bookings and as a result, purchases of new planes has stalled, no pun intended. Part of this is due long-term elevated cost increases as well as to terrorism as witnessed after 9/11. Much of the terrorism is financed by OPEC nations causing and benefitting from historically and persistently high oil prices. The high cost of flying has reduced the mobility of Americans significantly.

Not surprisingly, Boeing and Airbus have been hit by canceled orders (Agence France-Presse/May 9, 2012):

With 25 cancellations of 787 Dreamliners, against 19 orders so far this year, Boeing is in negative territory for its flagship aircraft built with composite materials that it says will use 20 percent less fuel than similarly sized aircraft.

…For its European counterpart [Airbus], the cancellation of seven A350-1000 aircraft by Abu Dhabi-based Etihad Airways represented a loss of $2.2 billion at catalogue prices.

The cost of transporting raw materials, semi-finished goods, and finished goods has risen markedly and with it, rising prices accentuated by de-contenting. Ask the household person that does the shopping and is increasingly vocal about such rising prices. Ask the restaurant owners who have experienced an upward explosion of prices they pay for food and reinforced by persistently high unemployment rates reducing customer traffic causing a severe decrease in their profit margins.

These increases in transportation costs cause markets to shrink and as explained above, gradually reduce the degree of the division of labor (specialization of productive resources). The ultimate result of this is to reduce the productivity of the productive resources and the overall standard of living. Economic growth slows and the term economic stagnation reappears in the headlines.

When I was growing up in Southwest Detroit, I had a neighbor who often uttered his philosophy of life,” Hooray for me and to hell with everybody else.” Without significant competition, large firms as in the highly cartelized oil and gas industry, have the market power to increase profits and their rate of return on equity (ROE) by restricting production and raising prices rather than increasing production and causing prices to be lower. Adam Smith saw this clearly as was quoted above. The large oil and gas firms act and sound like my old neighbor in Southwest Detroit.

The influence of the Malthusian fear of population also has negative effects on size of the market, division of labor, productivity, and economic growth similar to the rising costs of transportation. It is truly a situation where “people need people.” In their (households) dual role as productive resources and consumers:

People are the productive resources (labor, capitalists, etc.) as well as the consumers of firm’s products; People are the savers and enable capital accumulation; and People are the ones who are the entrepreneurs.

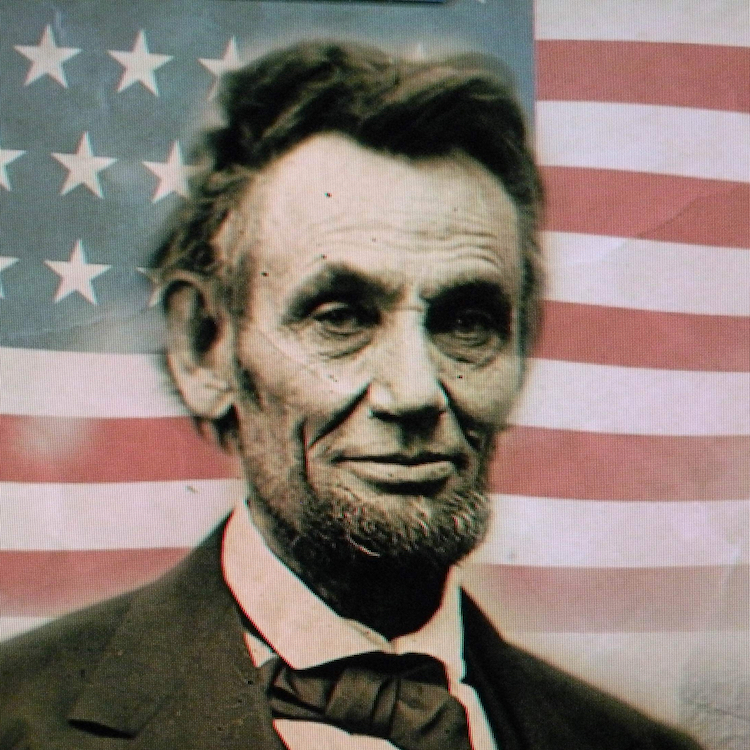

To paraphrase from Abraham Lincoln in his Gettysburg Address who of course borrowed from the U.S. Constitution:

Economic activity is of the people, by the people (productive resources) and for the people (consumers who are directly about two-thirds of aggregate demand).

People as productive resources are the supply side of the market and people as consumers are directly related to about two-thirds of the demand in markets and indirectly to the rest of the demand in the markets.

The European Malaise Most European countries’ reproduction have fallen resulting in imploding populations increasingly dependent upon migrants who often have conflicting cultural values. Even without migration, slowing economic growth is resulting in their governments’ inability to sustain existing government financed programs. Markets shrink, employment falls along with productivity, and disorder in the streets in an increasingly common occurrence. Greece, Spain, France, etc are current examples, highlighting the latest threat to economic viability: the new catchphrase is ‘Sovereign Risk’, where industrialized nations are facing Third World choices in dealing with debt crises. To this we can add, imploding markets and all that it entails.

Back to the basics!