For those who care about such matters, an utterance is said to reveal man’s smallest unit of speech. Somewhat remarkably, words like ugh, hmm, or gotcha may even qualify as guideposts that define our human history. In order, that first word might represent a caveman seeking clarification from his partner while the second represents the sound of a Medieval professor as he ponders the mystery of “global warming” absent the presence of an internal combustion engine. Lastly, this final utterance may remind us that we have left both our caveman and professor and have successfully arrived in the 1970s. And while nervously sitting through fifty-five minutes of Hawaii Five O, we reach the climactic moment: Gotcha. Book ’em Danno.

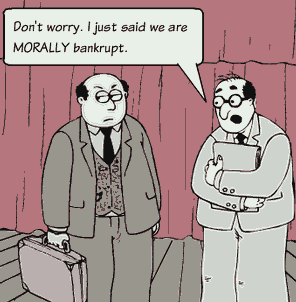

The bottom line is that whether an utterance be a single word or a string of words, a case may be made that words have meaning. And while never having counted the number of words in a dictionary, in our day, one word has become increasingly popular: bankrupt.

According to United States Courts.gov, “a bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.” But although this definition is tight and compact, I am left to wonder about its wisdom.

Are we truly left with no debts due?

In recent months, Reason.com published a story detailing the bankruptcy proceedings of Stockton, California. There, we are informed of government officials being “awarded” $200,000 annual pensions while grand buildings (now nearly vacant) are being erected. With scant thought given to how such pensions or building construction would be repaid, it appears to be another classic taxpayer rip-off story coupled with that ominous “b” word. And with Stockton bankruptcy proceedings at full throttle, the author provides us with an eerie omen: Is your city next?

While that question rings in our ears, we might do well to reflect upon another. Is bankruptcy merely a financial matter, or does it express something more? In his essay, How times have changed, Professor Walter Williams does just that.

“Years ago, spending beyond one’s means was considered a character defect. Today not only do people spend beyond their means but also there are companies that advertise on radio and TV to eliminate or reduce your credit card and mortgage debt. Students saddled with college loans have called for student loan forgiveness. Yesterday’s Americans would have viewed it as morally corrupt and reprehensible to accumulate debt and then seek to avoid paying it. It’s nothing less than theft. What’s worse is there’s little condemnation of it by the rest of us.”

In reading those words, I remembered a story about my grandfather. During the 1940s, while busy helping my grandmother raise a family of twelve children, he built a large poultry farm. However, one evening he met tragedy when his hatchery burned to the ground. Having been built with a downpayment, sweat equity, and borrowed funds, he was left with no hatchery and no income. Fortunately, he still had his wife and twelve children (my mother counted among them). But now having the responsibility of building a new life for his family, he also pondered that bank loan. A few years before his death, I asked him what provisions had been made for its repayment. He told me that it took thirty years for repayment, but that final payment had been made. I remember asking him about the possibility of bankruptcy, to which he interrupted me and said:

Oh, no, for I gave those men at the bank my word. And for me, there is nothing more important.

In returning to Professor Williams, he reminds us that our legal, police, and criminal professions are a society’s “last line of defense.” In echoing the words of my grandfather, he points to norms that truly matter:

“These behavioral norms — transmitted by example, word of mouth, religious teachings, rules of etiquette and manners — represent a body of wisdom distilled over the ages through experience and trial and error. They include important legal thou-shalt-nots — such as shalt not murder, steal, lie or cheat — but they also include all those civilities one might call ladylike or gentlemanly behavior.”

And so, the question haunts us. With financial bankruptcy, are we truly left with no debts due? While true that such civil decrees absolve us from certain responsibilities, I am left to wonder about the remaining residue. Perhaps the words of St. Paul (Romans 13:5-7) provide some clarification:

“Therefore, one must be subject, not only to avoid God’s wrath but also for the sake of conscience. For the same reason you also pay taxes, for the authorities are ministers of God, attending to this very thing. Pay all of them their dues, taxes to whom taxes are due, revenue to whom revenue is due, respect to whom respect is due, honor to whom honor is due.”

In looking around, it appears that we have surrounded ourselves with every utterance, convenience, or excuse to not do the right thing. And for those of us who try, we become depressed and anxious that our world seems to be falling apart. But with these feelings welled up inside of us, may we turn to Jesus. For while hanging from that lonely Cross at Calvary, hope seemed distant, if not extinguished. A bystander remarks: “Are not faith, hope, and love connected?” And Jesus answers him, as He answers you and me. (Mk 11:22)

Have faith in God.