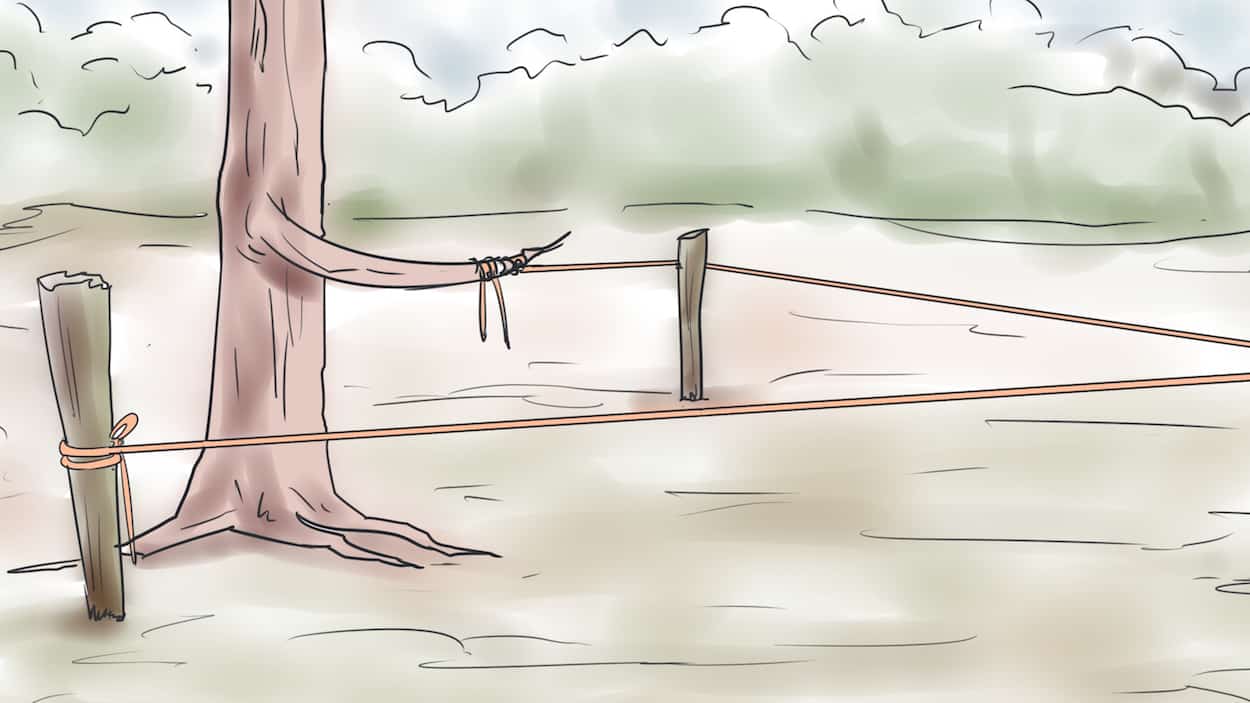

Protectionist storm clouds are on the horizon. As the fifth round of NAFTA negotiations begin without the principal representatives, our trading partners remain far apart on critical issues such as domestic content requirement and sunset provisions for treaty withdrawal. President Trump pulled the United States out of the Trans-Pacific Partnership discussions with a view toward pursuing bi-lateral negotiations with each nation. The administration has already imposed lumber tariffs against Canada and is prepared to use a little-known rule called Section 232, using American national security as a reason to place tariffs on steel early next year. This mercantilist approach to international affairs stands in stark contrast to the progress and success global trade has afforded the United States since the end of the Second World War.

There have been three major global trends since 1945: falling political barriers, increased technological development and increased trade. These trends intensify two factors: decreased transaction costs and increased resource mobility. As the world becomes more interconnected, prices fall due to increased competition. This provides benefits globally as consumers purchase the best product at the lowest price. Worldwide, resources move quickly. What used to be impediments to trade such as mountains, oceans and great distances have been overcome by technology and modern transportation. Container ships and oil tankers transit the world carrying goods. Intermodal transportation has made truck and railroads innovative partners. Capital moves easily, as trillions of dollars per day flow though the international financial markets.

Trade works and has stood the test of time. We conduct trade because it is necessary. Trade promotes competition and innovation, making producers more efficient. The recent backlash is partly due to trade being viewed as a revolutionary process, rather than an evolutionary one. The reemergence of global trade occurred after the “75-year emergency:” World War I, The Great Depression, World War II and the Cold War. During this period, much of the world was blocked from trade. After the fall of the Berlin Wall, nations reestablished trading patterns that existed before the First World War. From 1815 to 1914, the United States grew as a developing nation benefitting from global commerce with the British Navy protecting the trading lanes. The overriding benefit of trade is peace. You do not declare war on your customers.

The arguments against trade made by the Trump Administration are understandable. There are winners and losers in globalization. Resources move to their most highly valued use. Jobs shift world-wide. Those unable to find work often lack the new skills to transition to a more information based society. This is especially true in the automobile industry. Clay and wood models used for design and testing have been replaced by software programs and simulation. Assembly lines are highly automated with computer aided welding and painting being the standard. Technology accounts for much of the job losses. The Ricardo Effect occurs, as labor is replaced with capital. This trend has occurred for centuries but is intensified by technology and global linkages between nations.

The Administration is also attempting to blame the trade deficit for our loss of jobs. This deficit is a misnomer. The balance of payments between nations occurs on a balance sheet, not an income statement. The transaction ledger is the form of debits and credits, not revenues minus expenses. In reality, it is not possible to have a deficit on a balance sheet, it is by nature balanced. When goods are purchased from abroad, they are immediately paid for or financed. This is unlike a true deficit, run by the government when it spends more than it receives. This is historically important because Herbert Hoover attempted to balance trade by the use of the Smoot-Hawley Tariff. The result was a crash in the stock market before the bill became law, as markets discount future earnings. The Great Depression followed, as global trade decreased over 60% by 1933.

Blaming our trading partners and threatening to destroy trade agreements is not the answer. These allies have invested billions of dollars into the United States. BMW operates a production plant in South Carolina. Mercedes manufactures vehicles in Alabama. Toyota has assembly lines in Texas and Honda in Ohio. Foreign-owned companies are responsible for creating millions of jobs for Americans and providing work in industries that service those employees.

We must not be blind to violations of our rights and protections while trading with others. Free trade needs a strong and reliable partner: the rule of law. The underpinnings of the capitalist system rests on an unwritten honor code that must be adhered to by producers and consumers.

When a consumer pays, the transaction, whether in currency or credit, must clear. The good or service purchased must retain its value or use. Copyright laws must be respected. There are several bodies to address wrong doing, two of which are the International Trade Commission and the World Trade Organization.

The President is preparing to cross a dangerous tripwire, a mistake made by the Hoover and Bush Administrations. Pro-business Republicans are, once again, preparing to take a mercantilist sledgehammer to the delicate international trading system. As in 1929 and 2002, markets will react negatively to higher input costs, shortages and decreased future earnings. If our trading partners retaliate in kind, the gains from the Trump rally may be quickly erased. Everyone, including those seeking protection, will be adversely affected. Further, by retreating globally, the United States risks being replaced by an aggressive China that promotes global trade by pursuing a one belt, one road policy. Combined with unchecked military expansion in the South China Sea and the completion of a rail line from China to Europe along the old silk road, the Chinese will fill a vacuum left by an increasingly protectionist America. Should the United States choose to impose steel tariffs, walk away from NAFTA and enter into cumbersome bi-lateral trade agreements, the future of peaceful global relationships will be at risk.

I bet your doom and gloom about Trump is totally wrong David. We now have a brilliant mind and a highly successful businessman in the White House vs the pathetic political hacks from the last two administrations. The days of ripping off America are coming to an end. And by the way, balance sheet transaction do affect profits and loss.