In case you haven’t looked lately, our National Debt is ticking at the rate of $14,708,320,000,000. I remember back in early August that our beloved leaders resolved this debt ceiling, at least I think they did? We heard about a large deficit reduction of at least $2.1 trillion dollars over a decade. The plan basically solved nothing. It included no tax or entitlement reform measures up front, although it theoretically left the door open to both. The framework raised the debt ceiling immediately by $400 billion and then by another $500 billion after September 30. Now somewhere in the not too distant future, deep cuts are to be enacted. However, the debt ceiling is scheduled to be increased by a total of $2.1 trillion. This $2.1 trillion dollars should cover the Treasury’s borrowing needs until 2013. The $400 billion and $500 billion dollar immediate increases in the National Debt are part of the $2.1 trillion dollars. Somewhere in this legislative package, mention is made of a deficit reduction of between $1.2 trillion and $1.5 trillion dollars to be determined by the end of the year.

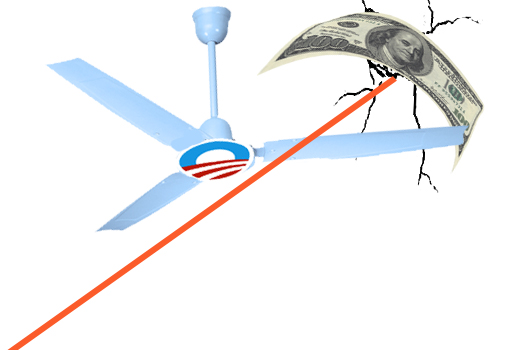

If you are a little confused, don’t feel that you are alone. The tricks are in the wording. Did you catch the phrase “over a decade”. The deficit reduction is long term. Increases to the National Debt are immediate. The framework called for more deficit reduction to be determined by the end of this year and imposed over 10 years. This second round of deficit reduction is to be determined by a special bipartisan joint committee of Congress. The committee has until Thanksgiving to come up with its proposals and those proposals would be guaranteed by an up or down vote without amendment by December 23. Now here is the kicker, “If the committee proposes and the Congress approves between $1.2 trillion and $1.5 trillion dollars in cuts, the debt ceiling will be increased dollar for dollar.” So folks, we are not making cuts in our National Debt, we are merely offsetting cuts with increases! This is the ultimate in “smoke and mirrors.”

So along comes President Obama with a Jobs Act. This is basically another stimulus. He lays out a $447 billion dollar legislative package that features a mix of tax cuts for businesses and workers, billions in new infrastructure spending and aid to states, and an infusion of aid for the long-term unemployed. The total $447 billion dollar price tag would be “fully paid for” if enacted in its entirety. However, the burden for covering the cost largely falls on the new congressional super committee already tasked with finding $1.5 trillion dollars in deficit reduction by the end of the year. This is similar to Mr. and Mrs. Jones saying we are going to put money against our MasterCard this Fall to offset the new car that we are going to buy next week! Again, folks, there is no permanent reduction in the National Debt. To the best of my knowledge, the new congressional committee has not identified $1.00 yet of the $1.5 trillion dollars in deficit reduction that they are charged with making. And even when they do identify the $1.5 trillion dollars in deficit reductions, the National Debt will go up dollar for dollar to offset these reductions. The best that could be said of the whole mess is that if it was successful, we would owe no more than what we owe now but absolutely no less. The Debt Ceiling Deal was utterly meaningless.