The current impasse over the increase in the national debt ceiling highlights the longer term issue regarding America’s growing and unsustainable liability. For years, market participants have been signaling their displeasure over our massive national debt. After the great financial crisis, cryptocurrency emerged as a new alternative to traditional forms of transaction settlement. Lacking global acceptance, stability and a steady store of value, its presence in the global marketplaces does indicate gradual approval of another form of non-governmental money. Lack of confidence in federal bank regulators, long term devaluation of the dollar and other factors have led to the development of Bitcoin, Ethereum and other virtual currencies.

Over the past ten years, the central banks of Germany, India, Russia and China have accumulated billions of dollars in physical gold. China and Brazil recently signed an agreement allowing their nations to conduct trade in their own currencies. China has purchased oil from Russia in rubles and yuan. Many of these transactions are made to avoid American sanctions regarding the Ukrainian war. From January 2022 to January 2023, Japan and China have reduced their holdings of U.S. debt by $196 billion and $174 billion respectively.

The price of gold has soared as the currency has been devalued and the debt expanded. At the end of fiscal year 2001, the price of gold was $291.55 per ounce. The national debt was $5.8 trillion. The current price of gold is $1,963 per ounce and the debt is $31.4 trillion. There appears to be a direct correlation. The emergence of crypto, foreign dealings in non-U.S. dollars, the physical accumulation of gold and the rise in the price of gold are all gauges on the economic dashboard of the global economy. These indicators are not “red lining” yet, but only a policymaker on a fool’s errand would ignore them.

The half century experiment in debt expansion finds its roots at the end of the 1960’s, when the nation attempted to fight a war on poverty and the war in Vietnam. On August 15, 1971, President Nixon removed the United States from the gold exchange standard, effectively closing the gold “window,” as a run on the gold stock by European nations became a distinct possibility. The markets feared there were too many dollars in circulation without gold to back the currency. The resulting half century expansion of the national debt and money supply at rates which far exceed the growth of the economy have provided a toxic elixir of inflation to ravage the poor, middle class and those on fixed incomes.

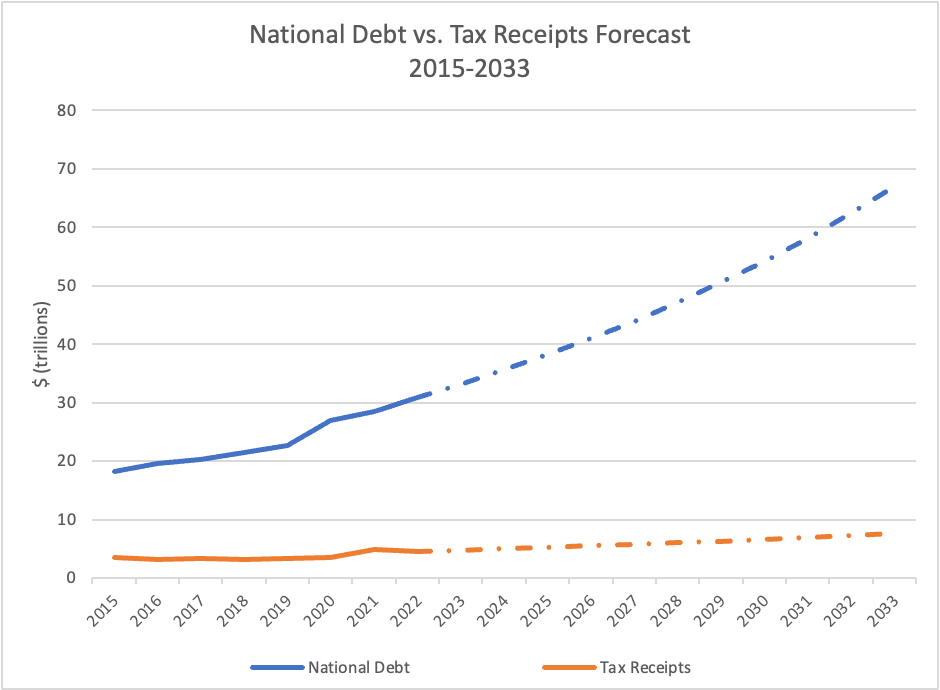

Here are the harsh realities. At the end of fiscal year 2015 the national debt stood at $18.1 trillion. The current level is $31.4 trillion. From 2015-2022 tax revenues averaged roughly $3.6 trillion. At the current rate of growth in the debt, without adding additional liabilities, the national debt in 2028 will reach $47.1 trillion. In 2033, the debt will be $66.9 trillion. The federal government will certainly increase annual deficits. Treasury Secretary Janet Yellen recently stated that the budget deficit in the first six months of fiscal year 2023 reached $1.1 trillion.

Sources:

Note: Projections are based on the average of year-to-year growth calculations of tax receipts & national debt over the past seven years.

In March 2020, the debt rapidly increased following the Federal Reserve’s pledge to backstop most financial instruments, stabilizing the financial system and the broad economy. Three trillion dollars, displayed in M-2, entered the banking system between March and September 2020. During the next two years, the passage of the $1.9 trillion American Rescue Plan, the $737 billion Inflation Reduction Act and the $1.65 trillion Omnibus Budget contributed to a further devaluation of the world’s reserve currency. Additional spending of $100 billion to support Ukraine and a proposed $400 billion student loan forgiveness adds to an already untenable deficit situation.

Historically, debasement of currency occurred when coins were clipped or precious metal was removed and lead substituted for silver or gold. This occurred in Rome and resulted in the destruction of the Roman currency. The physical printing of paper money resulted in fiat inflation, France in the eighteenth century and Germany in the twentieth. During the American Revolution the phrase, “It ain’t worth a continental was born,” due to the devaluation of the continental dollar. This devaluation and those in history led to the inclusion of a gold and silver standard in Article 1, Section 10 of the U. S. Constitution. The founding fathers understood the effects of inflation and a commoditized standard as the best method to contain it. The money stock can only expand as rapid as gold or silver can be mined and a reserve kept for meeting withdrawals.

Currently, the United States suffers from fiduciary credit inflation. Electronic money expanded though a fractional reserve banking system. The greatest danger in this framework is a run on the banks since most of the money is loaned out.

Like the beginning of World War I, where the great powers were sleepwalking into darkness, so would some minor or asymmetric event trigger an unwillingness of lenders to sustain America’s national debt. Far worse, an event where existing lenders would intentionally coordinate a massive unloading of treasuries in conjunction with a military operation, would send our economy into a tailspin. China and Russia would destroy the value of their underlying holdings and the Federal Reserve would be required to step in and purchase treasuries in open market operations. Nonetheless, the US economy would be in turmoil. Massive debt and the future liabilities are a sign of weakness, not strength.

All spending bills originate in Congress and this body must slow the rate of growth of the debt. Entitlements must be addressed. Demanding less from younger people toward social security will decrease their entitlements when they are older. The government will need to limit further liabilities if trust is to be maintained.

The public often says the sky is falling and for decades the nation has continued to move forward. The main reason that it is “different this time,” is there are numerous indicators that are signaling a problem: price of gold, accumulation of gold, emergence of crypto, global non-dollar denominated transactions, rate of interest of the debt and the trajectory of the debt itself. Ronald Reagan and Tip O’Neill found compromise in the 1980’s. Bill Clinton negotiated with Bob Dole and Newt Gingrich in the 1990’s. Washington needs to find a solution to our fiscal insanity and debt impasse.

Like the approach of distant thunder, America’s growing debt crisis is becoming more audible with every passing year. There is no magic number that will bring this issue to a head. The law of large numbers combined with the magic of compound interest is working against the United States. As the Federal Reserve Chairman Jerome Powell stated, “the national debt is unsustainable.” If the government cannot thoughtfully resolve this issue soon, the capital markets may act on their own.