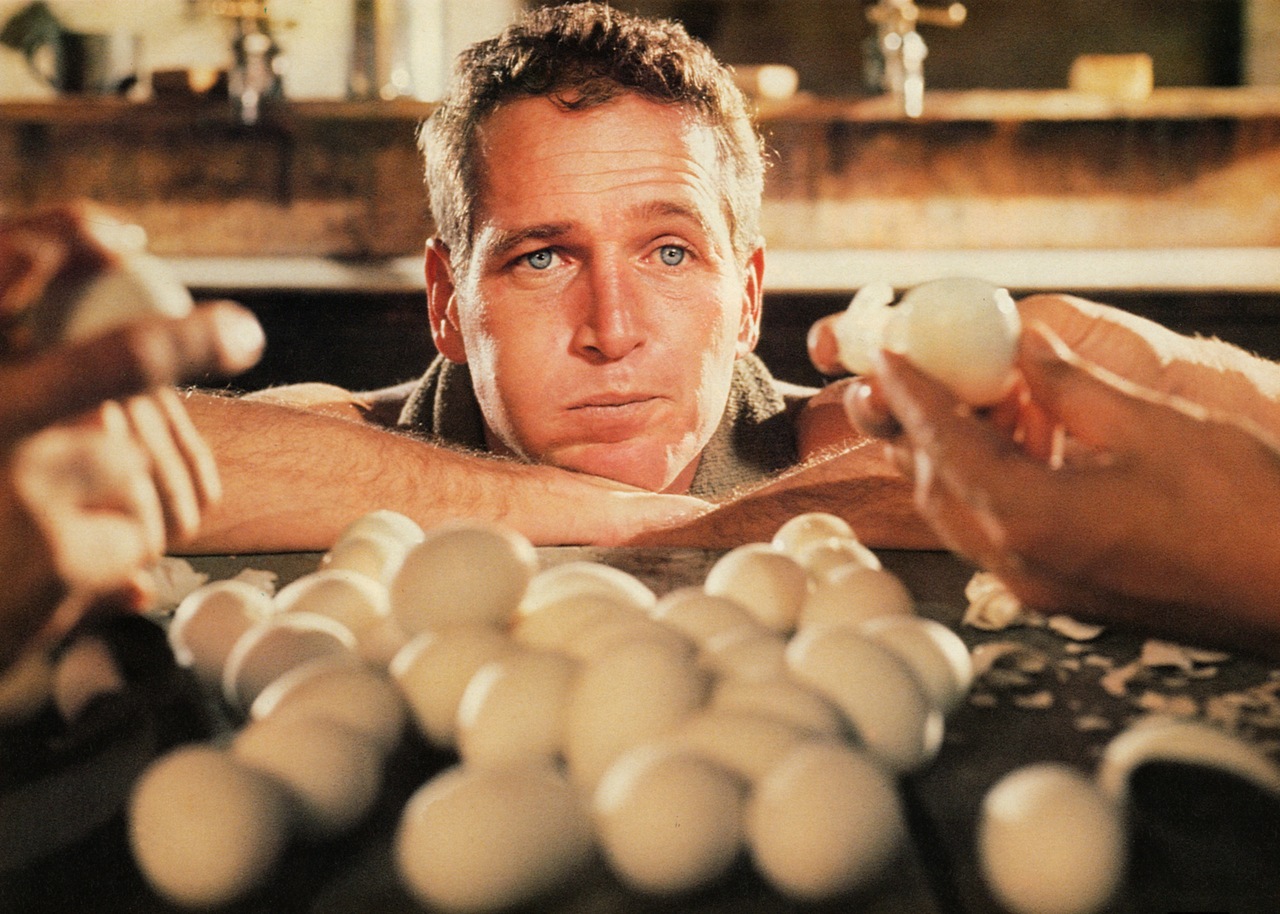

“What we’ve got here is failure to communicate.”

–Prison warden – Captain (Strother Martin) in Cool Hand Luke

In the real world a ‘short circuit’ can and often does occur in markets, preventing an optimal allocation of resources through the supply and demand clearing mechanism. These short circuits, or system failures, reduce the ability of free market capitalism to achieve the microeconomic welfare goals of equity and efficiency as well as the macroeconomic goals of high employment and a reasonable degree of price level stability. Again, these failures also reduce the conformity of free market capitalism to the principles found in the social encyclicals of the Catholic Church, namely subsidiarity, solidarity, and justice in its various aspects (commutative, distributive and social). In economics, the term “market failure” is usually applied to these shortcomings. These failures can range from insignificant to very significant and can cause both short-run and long-run departures from the attainment of the economic welfare conditions as well as reducing conformity to subsidiarity, solidarity and justice.

The existence of natural monopolies and natural oligopolies are one aspect of such market failure. Natural monopolies, where there is only room for one participant in a given market, include public utilities. Automotive firms are an example of a natural oligopoly, where the market participants are typically large and few in number in order for production levels to approach the minimum of each firm’s average cost. The total market is not large enough for the number of firms to approach a significant level of competition.

A second type of so-called market failure is the existence of goods or services that are not rival in consumption. In this case, the non-payer cannot be excluded from benefitting from the good or service. This gives rise to the ‘free-rider” syndrome and results in the unwillingness of many consumers to reveal their preferences. An example would be flood control, where, without government involvement, a multimillion dollar flood control structure would likely not be put in place. Since no one person or group of people would be willing to voluntarily pay for the construction and maintenance, we say that a less than the optimal quantity will be produced by the market.

A third category of market failure is the case of externalities. When external costs exist, the firm does not bear all of the costs of society and thus prices its product too low resulting in over production or greater than the optimal levels in light of all the costs, internal and external. Electric power production is usually cited as such an example. Legislation attempts to correct the problem of emitting ‘excessive pollution’ by internalizing the external costs associated with the pollution, resulting in higher prices and bringing production toward a more optimal level.

Likewise, the presence of external benefits also occurs. Education is the poster child for this market failure where without market intervention, too little production is the result. The buyers of the education product — students, parents, employers, etc., undervalue education’s total benefits to society. Total benefits to society exceed the private benefits to those being educated. Legislation seeks to internalize the external benefits and increase production, or so the argument goes.

“We have tried spending money. We are spending more than we have ever spent before and it does not work.”

–Henry Morgenthau, U.S. Secretary of the Treasury, May 9, 1939 (House Ways and Means Committee)

Government Intervention and the Potential for “GOVERNMENT FAILURE”

In the case of natural monopolies such as public utilities, regulatory commissions theoretically seek to set prices that will achieve either efficiency or equity. In most cases, both welfare conditions cannot be simultaneously achieved so one is chosen. Depending upon the behavior of costs, etc, if the criterion of efficiency is chosen, price will be set equal to marginal cost. This often results in surplus profits violating the criterion of equity.

If the criterion of equity is chosen, price is set equal to average cost and usually results in in a violation of efficiency as the price so established by the commission is less than marginal cost.

In the case of natural oligopolies, anti-trust legislation is usually established by the legislative body to prevent excessive concentration that is not needed to approach the minimum average costs. Guidelines such as three, four, or five firm concentration ratios and the Herfindahl-Hirschman Indices are utilized to limit unnecessary concentration.

THE HERFINDAHL-HIRSCHMAN INDEX

“HHI” means the Herfindahl-Hirschman Index, a commonly accepted measure of market concentration. It is calculated by squaring the market share of each firm competing in the market and then summing the resulting numbers. For example, for a market consisting of four firms with shares of thirty, thirty, twenty and twenty percent, the HHI is 2600, (302 + 302 + 202 + 202 = 2600).

The HHI takes into account the relative size and distribution of the firms in a market and approaches zero when a market consists of a large number of firms of relatively equal size. The HHI increases both as the number of firms in the market decreases and as the disparity in size between those firms increases.

Markets in which the HHI is between 1000 and 1800 points are considered to be moderately concentrated and those in which the HHI is in excess of 1800 points are considered to be concentrated. Transactions that increase the HHI by more than 100 points in concentrated markets presumptively raise antitrust concerns under the Horizontal Merger Guidelines issued by the U.S. Department of Justice and the Federal Trade Commission. See Merger Guidelines § 1.51.

In the 1950s and 1960s, the U.S. auto industry was thought by many to be overly concentrated. General Motors was the focus of much anti-trust activity. More recently, the U.S. segment of the oil industry was allowed to become much more concentrated in the period from 1993-2003 as 13 firms merged into 5 even larger firms. The anti-trust authorities did little to stop it. The much higher priced oil and derivative petroleum products we have been experiencing in the last few years are partly explained by that failure.

The markets are essentially communication systems. When all of the factors affecting supply and demand are not fully communicated to the system as in the case of external costs and external benefits, production levels can violate the dictates of efficiency by under or over production. Government, often through legislative discernment, seeks to correct such inadequacies of the market. The term market failure is usually applied to such a situation. As previously pointed out, external costs such as pollution tend to result in over production and thus violate the welfare conditions. External benefits result in under production. The purpose of such government intervention is to internalize the externalities and bring the economy in closer conformity to its welfare goals. As explained above, market failure also includes the case of goods and services such as flood control reflect an inability of the market to preclude non-payers from benefitting from the benefits. Less than optimal production results and economic welfare is not fully achieved. Government intervention results in flood control projects and most that benefit are forced to pay through taxes. This discernment process and government intervention is not fool proof and can result in what is termed “government failure.”

“The American Republic will endure until the day Congress discovers it can bribe the public with the public’s money.”

–Alexis De Tocqueville, Democracy in America, 1835

Problems with the Discernment Process

The discernment process is often a faulty one, biased by political forces having a vested interests influencing the outcome of such a discernment process and at times driving the economy farther from optimal levels of production rather than closer to conformity with these welfare goals. This “government failure” is often cited by those on the far right such as Libertarians, as a pragmatic reason to justify their more extreme views against most government intervention.

Others criticize the discernment process by legislatures as made more difficult by biased research that obscures the reality of the equity problem.

To cite Joseph Campbell (May 24, 2003), in Poverty: A bias toward exaggeration:

“The statistics commonly cited to track poverty in Canada are not merely deceptive: they are systemically flawed. They cannot help but exaggerate what they are supposed to measure. Their use may enhance the prospects of anti-poverty activists, who have learned from feminists, minority group leaders and environmentalists that you can make a good living out of hyperbole. Their constant repetition trivializes the plight of those coping with real poverty and the pathological effects of dependency.”

Some long-run effects of the power of competition to achieve the welfare goals as well as conformity to the Catholic Church’s social teaching

As an economy develops and real output grows, the distribution of productivity gains is very sensitive to the degree of competition in the product and productive resource markets. This in turn determines to what degree the economy conforms to the welfare goals of the micro and macro economy as well as the degree to which economic activity conforms to the principles of subsidiarity, solidarity, and justice in its various aspects.

The more competitive are product and productive resource markets, the more likely are product prices to gradually fall as some of the productivity dividend is passed forward in the form of lower prices as a result of competitive pressures. This would result in a very mild deflation over the long-run as the inflationary bias resulting from the lack of significant competition would be reduced as competition increases. To the extent that the productivity dividend was due to the increased productivity of productive resources such as embodiment of human capital in labor, the resources would experience a rise in their opportunity costs and to that extent some if the productivity dividend would accrue to them as a higher reward for supplying their resource to the process of production.

Equity is not equality! Longer hours, bearing greater risks, embodying greater knowledge, and deferring consumption are some of the factors that dictate higher opportunity costs and value to society. The resulting inequalities are not contrary to commutative justice but embody it more fully. Higher rewards for exercising market power, however, also result in a more unequal income distribution and are in violation of not only equity but commutative justice as well.

Where market imperfections occur, the discernment process, when operating properly, can bring those markets in closer congruency with the economic welfare conditions as well as with the principles of subsidiarity, solidarity and justice in its various aspects.