Several days ago, the Bureau of Labor Statistics issued a report based upon their last Establishment Survey of Employment, which covers other topics as well, one of which is labor productivity. Besides reporting a dismal sub-par increase in jobs, it also reported a significant decline in the productivity of labor.

According to the U.S. Bureau of Labor Statistics, “Nonfarm business sector labor productivity decreased at a 0.9 percent annual rate during the first quarter of 2012. The decline in productivity reflects increases of 2.4 percent in output and 3.3 percent in hours worked.”

What this means is that while output increased, the hours of work it took to produce that marginal output increased at a more rapid rate; hence, the per unit cost of that output increased, resulting from a decline in the productivity of the labor employed.

In the June 6, 2012 edition of The Daily Finance, it was noted that “U.S. worker productivity fell by the largest amount in a year from January through March. The steeper drop than first estimated suggests companies would need to hire more if demand were to pick up.”

Likewise, on that same day, Associated Press Reporter, Martin Crutsinger, posted an article wherein he made the argument that this reported drop in labor productivity should trigger an increase in employment to offset that very decline in labor productivity. This may be the scenario, but we very much that this reference to demand picking up augurs an increase in labor hiring to compensate for the decrease in labor productivity. Historical evidence argues the other way.

From a macroeconomic perspective, this may be solid evidence that a further recessionary dip is underway in the U.S. economy. Economic history has shown us on many occasions, that in the initial phase of a recession, the first sign is a decline in labor productivity. Why is this so, you may ask? Well, firms are reluctant to lay off labor until they are sure the weakness in demand will be lasting. As they cut back production, due to the weakening demand for their product, labor productivity declines. Only when they are sure that demand will not pick back up, will they undertake layoffs of labor. Unfortunately, a decline in labor productivity can be caused by other factors, but just the same, recessions usually begin with a decline in labor productivity. This is especially true after a period of strong recovery and growth, and while the U.S. economy has definitely NOT been experiencing an economic rebound, it can also occur if firms had already been at a relatively barebones level as is currently the case.

The decrease in the real rate of growth in GDP last quarter, while a bit complex causation-wise, is further evidence of a possible beginning of a recession. Capital goods spending also showed strong evidence of weakening.

If the recent slight uptick in the labor force participation rate is reversed, and the encouraged workers revert to being once again discouraged workers, it will be further evidence of a weakening economy and along with other labor market figures could indicate a recession had begun or is about to begin. The evidence seems to be mounting.

There is a bit of ambiguity in the data from the most recent quarterly and monthly reports coming out of the U.S. Commerce and U.S. Labor Departments. The drop in labor productivity could be interpreted as resulting from microeconomic causes. A decrease in some sectors (e.g., manufacturing) relative to others in the Establishment Report could account for an increase in hours worked at the same time that labor productivity was falling. This would be consistent since the various sectors have different physical productivity patterns.

Light vehicle sales peaked in February of 2012 at a seasonally adjusted annual rate (SAAR) of around 15 million units, but then began a downward slide through May to 13.7 million units (SAAR), according to the latest data available.

Ending in February, this spike in light vehicle sales is attributable by most analysts as a response to pent-up demand related to the massive fall-off in light vehicles over the past few years. At least some of the increased production certainly resulted in more labor hours in the form of overtime. Increased usage of overtime often accompanied by a drop in marginal physical productivity of labor is due to a less efficient labor to capital ratio, a kind of diminishing returns, as well as the fatigue issue on the part of the workers. This is consistent with both the micro and macro aspects of labor productivity over this time period.

Given the most recent reports on manufacturing declines, such data is also consistent with the more historical macroeconomic productivity pattern of a decline in labor productivity occurring at the beginning of an economic downturn.

Now we can look more deeply into the microeconomic analysis of productivity. The issue of what is productive or creates ‘surplus value’ has a long history in economics. Perhaps the Labor Theory of Value has drawn the most attention. Whether it be David Ricardo’s version or that of Karl Marx, it has had many disciples through the last two hundred plus years. Socialism and its more virulent form, communism, are examples of economies, at least nominally, being directed by the Labor Theory of Value.

Land has been another candidate for the producer of surplus value whether it be the version of Francois Quesnay’s Physiocratic School, so influential on Adam Smith, or that reflected in Henry George’s land taxation system.

Our view is that all value, including surplus value, is created by human effort as it is directly or indirectly involved the transformation process termed production. The human beings living in households ultimately supply all the productive resources, labor, debt and equity capital, entrepreneurship, and land.

They are directly involved in the production process when supplying labor and entrepreneurship to the production process occurring at the firm where production occurs. Households (human beings) are less directly involved when they supply debt and equity capital and land. The latter two are a result of households earning incomes, saving or deferring consumption, bearing risks and investing their saving. Even if government intervenes in the production process, it is financed by taxes which are effectively a form of forced savings required of households, the fruits of which whether desired by the taxed or not desired, are collective consumption and investment.

Productivity comes in two basic metrics, the real physical productivity, such as in diminishing returns, or the monetized one such as in unit labor costs. Think of the Gross Domestic Product of an economy as the result of all of the productive resources that participate in the transformation process called production times their physical productivity monetized by the prices of those goods and services. GDP will increase in one of three ways: either the quantity of productive resources employed increases, or their productivity increases, or the market price of the product produced increases. The latter factor monetizes the change in real GDP.

While much of the literature on productivity focuses on labor, all resources (labor, debt and equity capital, entrepreneurship and land) are productive. All productive resources emanate from the direct or indirect involvement of households.

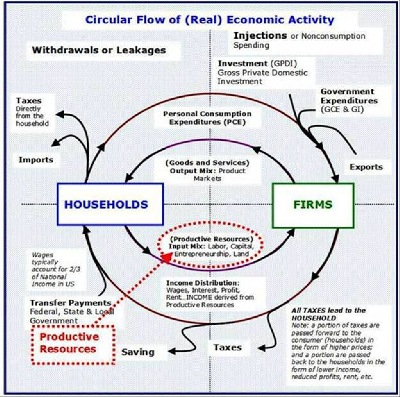

Let’s begin with the basics and a picture of the Circular Flow of Economic Activity. On the left-hand side of the circular flow of economic activity are the households. As explained above, in a free-market capitalistic system, households supply all the resources. They do this through direct involvement in the transformation process of production by supplying labor and entrepreneurship. The households are indirectly involved by supplying debt and equity capital and land to the production process. All resources are thus supplied by households to the firm.

The firm is the place where this transformation process of production occurs. That’s all the firm is, the place where production occurs. The firm is not the productive resources. The households supply the productive resources to the firm in order to earn or receive a reward that is called income. Income is the reward to households for the current supply of productive resources to the production process occurring at the firm.

At the firm these resources are combined and transformed into useful goods and services sold by the firm in the markets for goods and services, the upper half of the circular flow, the product or output markets. The households can then choose to spend this income by buying back the goods and services they helped produce through the production process. Households buy goods and services that are called consumption, technically Personal Consumption Expenditures (PCE). They also spend some of their income in order to buy residential housing, technically part of Gross Private Domestic Investment (GPDI) in the National Income and Product Accounts or NIPA.

That income not spent to buy back the goods and services they helped produce are called withdrawals and include saving, taxes, and in the purchase of those goods and services produced in the rest of the world, termed imports.

Note that in the market for goods and services, households demand the goods and services while firms supply those goods and services in these same product markets. The revenues to the firm are the expenditures of the households and other non-household buyers such as exports to the rest of the world, government expenditures on goods and services, so-called collective consumption and investment, and the investment spending on capital goods by firms and households. The non-consumption spending components are grouped together and are called injections which along with consumption constitute what is termed, aggregate demand.

If we move to the lower half of the circular flow of economic activity, we find the markets for the productive resources or input markets. Note the role reversal. In these markets, the households are the suppliers of the productive resources of labor, debt and equity capital, entrepreneurship, and land while the firms are the demanders of these productive resources. The income of the productive resources is a cost to the firms.

The productivity of a productive resource such as labor is what that resource adds to production or output when it is employed in the production process by the firm.

It may seem confusing to the reader, but the equity capitalist, the owner of the firm, is also employed by the firm that the equity capitalist owns. In effect, the equity capitalist is self-employed not as a worker but as an owner financing the assets of the firm along with the creditors, the debt capitalists.

It may also be confusing to the reader not well versed in economic theory, that the productive resource we refer to as labor is increasingly an embodiment of capital, human capital that is. The discipline of economics has been amiss in this regard. Education, training, etc are the ways of embodying human capital in labor. It, like physical capital such as machinery and factories is essential to increasing productivity and increasing the standard of living of society. One might reasonably argue that much of the expenditures on health care also maintain and increase the productivity of productive resources, especially that of labor. There is no free lunch in promoting productivity and the good material life.