Despite the most recent increase in the Federal Funds Rate (09/21/22), keep in mind that there is nothing to prevent the Fed from raising the targeted Fed Funds Rate before their next scheduled meeting. The FOMC meets at 6-week intervals and they certainly have made changes to the targeted Fed Funds Rate between meetings in the past.

I think they will continue to go hard and fast with the rate hikes without regard for damage to economic growth. The Fed is intent on putting the hammer down on demand-side inflation; that is, too many dollars chasing too few goods (and services). By driving up the targeted Fed Funds Rate, they are putting pressure on all interest rates. The reality is that consumers and businesses are very sensitive to interest rates and that will really tamp down economic activity.

The wildcard is really on the supply side of the inflation experience where the Fed has very little control over the environment. Focusing on two areas, labor markets and energy, we can readily see that the inflation is arising from a lack of supply in both areas. By reducing demand, the Fed actions will of course also impact the supply side. It won’t solve the supply side issue, but the reduced demand will lessen the pressure on supply.

The root problem with supply has to do with policies. In terms of labor, the added stimulus checks and the generous benefits, including the forbearance on student loans (repayments pushed back to next year), has lessened the need to seek employment.

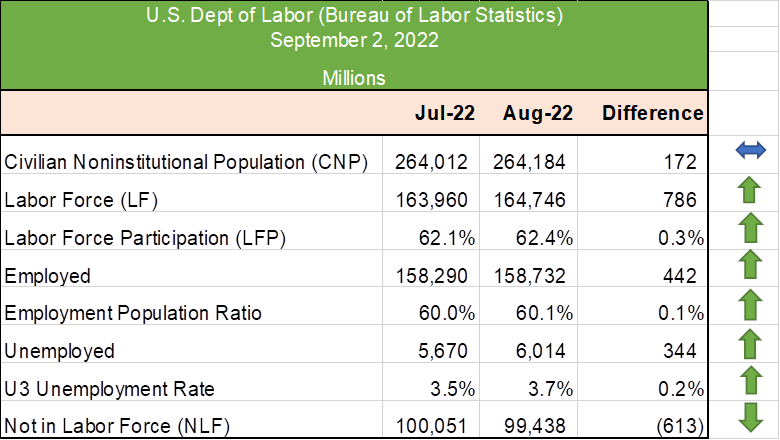

The reality is that labor markets still have significant slack (as reflected in the 62.4% Labor Force Participation Rate), but that is beginning to improve as more people are looking for employment as reflected in the latest employment report for August 2022.

In some ways the labor problem will heal itself over time, but the Fed tightening may very well short circuit that process. The good news is that wage inflation will certainly diminish, but the bad news is that unless the Fed wraps up its efforts (successfully driving the inflation rate down to the 2-3% range) quickly, it will have a chilling effect on labor markets.

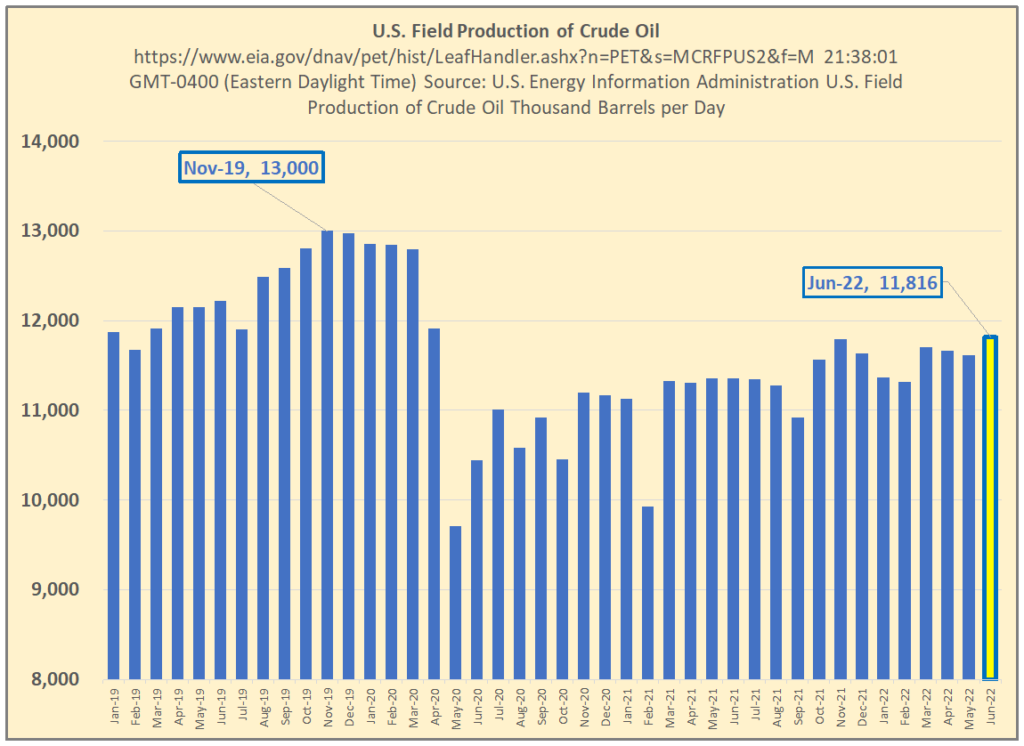

The other major issue on the supply side has to do with energy, fossil fuels in particular. The only way to ease inflation on the energy front in a meaningful manner is to reverse course on fossil fuels. We are well short of our pre-Covid production levels and we can’t grow our economy without energy. If you reduce the supply of energy, this causes prices to rise; this is basic common sense. It’s interesting to note that while natural gas production has picked up, the pressures caused by the shuttering of coal-fired facilities will just continue to put price pressure on natural gas.

When you combine drawing down the supplies of crude oil in the SPR (Strategic Petroleum Reserve) with reduced economic activity, that will certainly help to drive down prices, but it is only a short-term fix in terms of supply; it also adds unnecessary pain in terms of reduced economic activity (layoffs, etc.).

In summary, if we are willing and able to get people back to work and get our energy production back on track, this will be over fairly quickly. In the meantime, the Fed will continue to drive up the targeted Fed Funds Rate and put the hammer down on demand-side inflation with obvious consequences flowing through to the supply side.