Recently, on a social-media platform, I had the following conversation with a CEO regarding economic history. As you’ll note, history may be viewed from different perspectives.

MY INITIAL POST

During the Great Depression, FDR’s economic strategy was reflationism. This policy was all about reducing competition and enhancing market power in the hope of reducing and eliminating deflation. Unfortunately, it also worked to reduce demand because suppliers pulled back production to maintain profit margins.

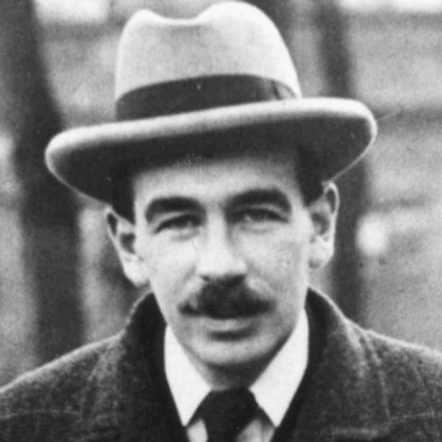

This is where the Keynesian bit comes into play. Since producers pulled back, there was reduced demand for employees resulting in massive and sustained unemployment. Government stepped in with programs like the CCC, WPA, etc. This was all aimed at getting people back to work, by ginning up demand (speaking to Keynes’ demand-side failure).

This roundabout approach was terribly inefficient, completely hamstrung the market clearing mechanism, but it was put in place with the understanding that the markets had failed…this was Keynes’ straw man, pointing out that government had to step in because J.B Say’s ‘market system’ had failed. This circles back to firms pulling back on production and charging higher prices.

This is a dangerous path that will leave us with high unemployment and lead to even further government-inspired intervention and economic malaise… not acceptable! We can and shall address the issues related to this shutdown and we can and will get this economy back on track.

HIS RESPONSE

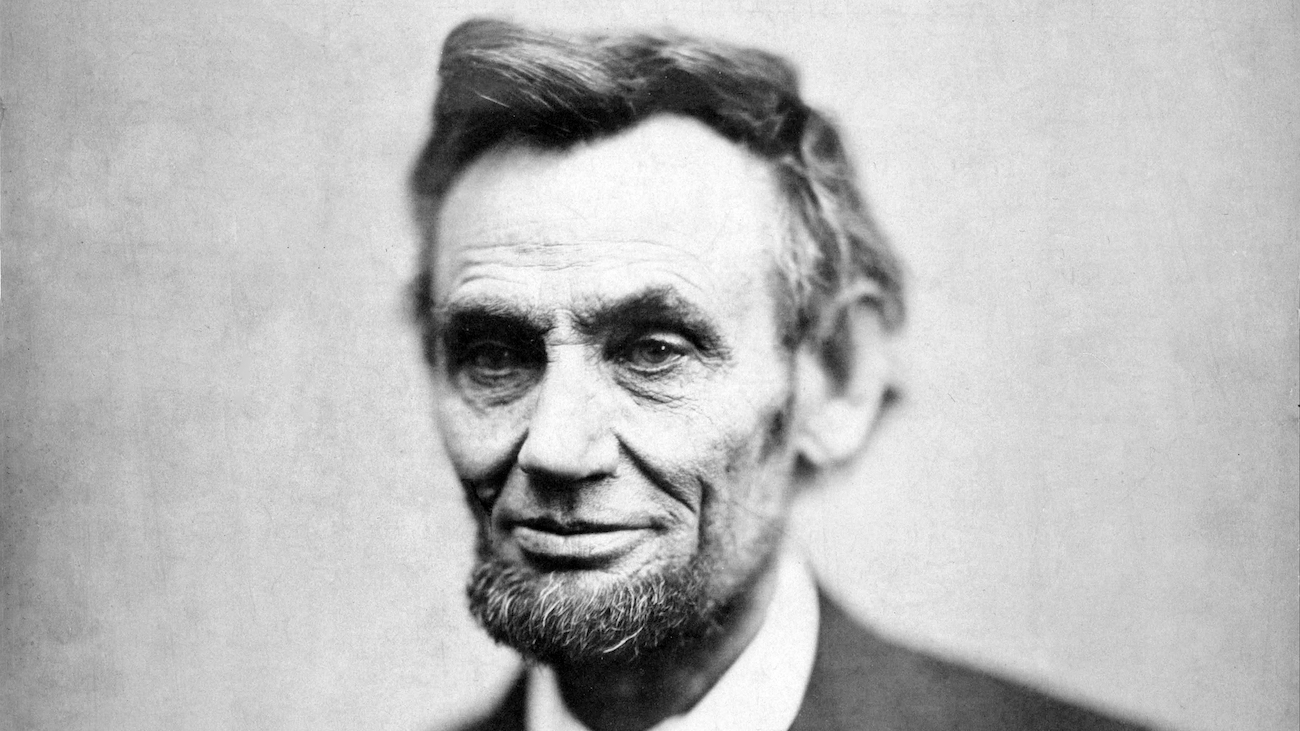

Herbert Hoover was the President when the Great Depression fully impacted our country from 1929-1933. I’ve NEVER heard the depression blamed on FDR. This is a first for Republicans of today. One thing we didn’t do then, which we’ve done now (and you can thank Congress for this and NOT Trump), is to provide any kind of economic stimulus when the country needed it. It may lessen the blow of this one.

MY RESPONSE

Keeping in mind that Hoover was seeking a third term and both he and FDR promised ever greater austerity measures to right the ship, you could certainly argue that FDR’s proposals were at least as draconian as Hoovers. FDR won in a landslide and there was a Democratic wave that rolled in at all levels of government. FDR quickly found that austerity measures were a no-go, so he implemented the agenda as we know it. The problem, or at least the result of the ever-increasing government presence in terms of regulation and its sheer growth, was that it stalled the private sector even further with such policies as the aforementioned reflationist strategy. The passage of the Social Security Act in 1935 and its implementation in conjunction with the expansion of other government programs, drove us back into recession and some argue that the Great Depression really lasted from 1929–1945. The late date includes WWII since nearly all economic activity was geared toward the production of war material, not the consumer (you couldn’t buy a refrigerator to replace your broken down unit, so the iceman was back in business). Perhaps interestingly, Truman tried to push FDR’s agenda even further at the close of World War II and was shutdown by a Democratic Congress. It took 25 years, from 1929 through 1955, to get us back to the previous Stock Market high.

So far as dealing with the current crisis is concerned, there has been little argument about salvaging as much of the economy and people as possible. If you want to credit Congress (House and Senate), that’s fine – it’s their job to pass laws. Basically, from what I can tell, Congress and the Executive branches have pretty much been in lockstep, with differences based on the extent of the government involvement and not on the implementation of the relief efforts themselves. Most everyone agrees that it is imperative to protect and salvage as much of the economy as possible employing all of the levers of government and so, it’s likely that we will have moved from $23 trillion in debt to $30 trillion before we’re through with this.